9 Easy Facts About Cpa Conroe Tx Shown

Wiki Article

Rumored Buzz on Tax Services Conroe Tx

Table of ContentsTax Services Conroe Tx for DummiesThe Only Guide to Cpa Near MeCpa Near Me for DummiesTax Preparation Conroe Tx Fundamentals Explained

A tax specialist can assist make certain that you have all the other information required for your return, such as your tax obligation basis, which might not show up on the 1099-B. Additionally, a tax pro can assist you report as well as take care of activities related to worker supply alternatives or limited supply.

This damages down (but doesn't overall 22 as a result of rounding) to 12 hours of recordkeeping, four hours of tax obligation preparation, 5 hours to complete as well as send kinds, and two hours for other jobs. Tax obligation software program costs depend on the particular software program that you pick and its features. A lot of software program companies have a cost-free online variation suitable for taxpayers with simple returns and incomes below a specific threshold (note that you may still need to pay to submit your state return).

Generally, the even more features and capabilities, the greater the price. According to the National Society of Accountants, the typical charge in 2020 (the most lately available data) to prepare Form 1040 with making a list of on Set up A was $323, including the state return. The average charge for Type 1040 with the standard deduction was $220 (again, with the state return).

The Only Guide for Tax Preparation Near Me

The ordinary extra fee was $42 for Schedule B, $192 for Set up C, $118 for Arrange D, and $145 for Schedule E. cpa conroe tx.

Charitable contributions philanthropic be tracked and substantiated (cpa conroe tx). Taxpayers usually miss out on out on this essential reduction since they failed to get and/or preserve proper documents. For weekly contributions to church or other spiritual organizations, regular participants are generally given a year-end statement with the total amount of their contributions yet offered the volume of such declarations offered by the establishments, inconsistencies can take place even in these documents, so taxpayers ought to additionally keep their very own documents.

One more usual charitable contribution mistake occurs when taxpayers obtain a benefit such as getting occasion tickets in exchange for their contribution. They often (as well as mistakenly) try to assert the total of their money payment without subtracting the fair market price of the tickets. The full deduction is readily available just if the taxpayer refuses the investigate this site tickets.

Tax Preparation Near Me Fundamentals Explained

One of the very first locations that the IRS look at a tax obligation return is math, particularly on those first two web pages of the return. If a paper tax obligation return is completed as well as submitted by hand, it's easy to miss a number or 2, so go gradually and confirm the mathematics.

A return is just thought about timely submitted if appropriately signed as well as submitted. Bear in mind that, if there is a joint return, both spouses have to sign the return for it to be legitimate. It is essential to make a click to investigate copy of authorized income tax return, as applications for several typical kinds of finances, including home mortgages and trainee lendings, call for past tax obligation details.

For taxpayers that moved in the past year, it is most likely that the appropriate Internal revenue service declaring office has transformed, so be certain to check the table in the back of the directions for where to submit the return. Negative amounts on the government return are to be shown with parentheses; don't utilize the minus icon.

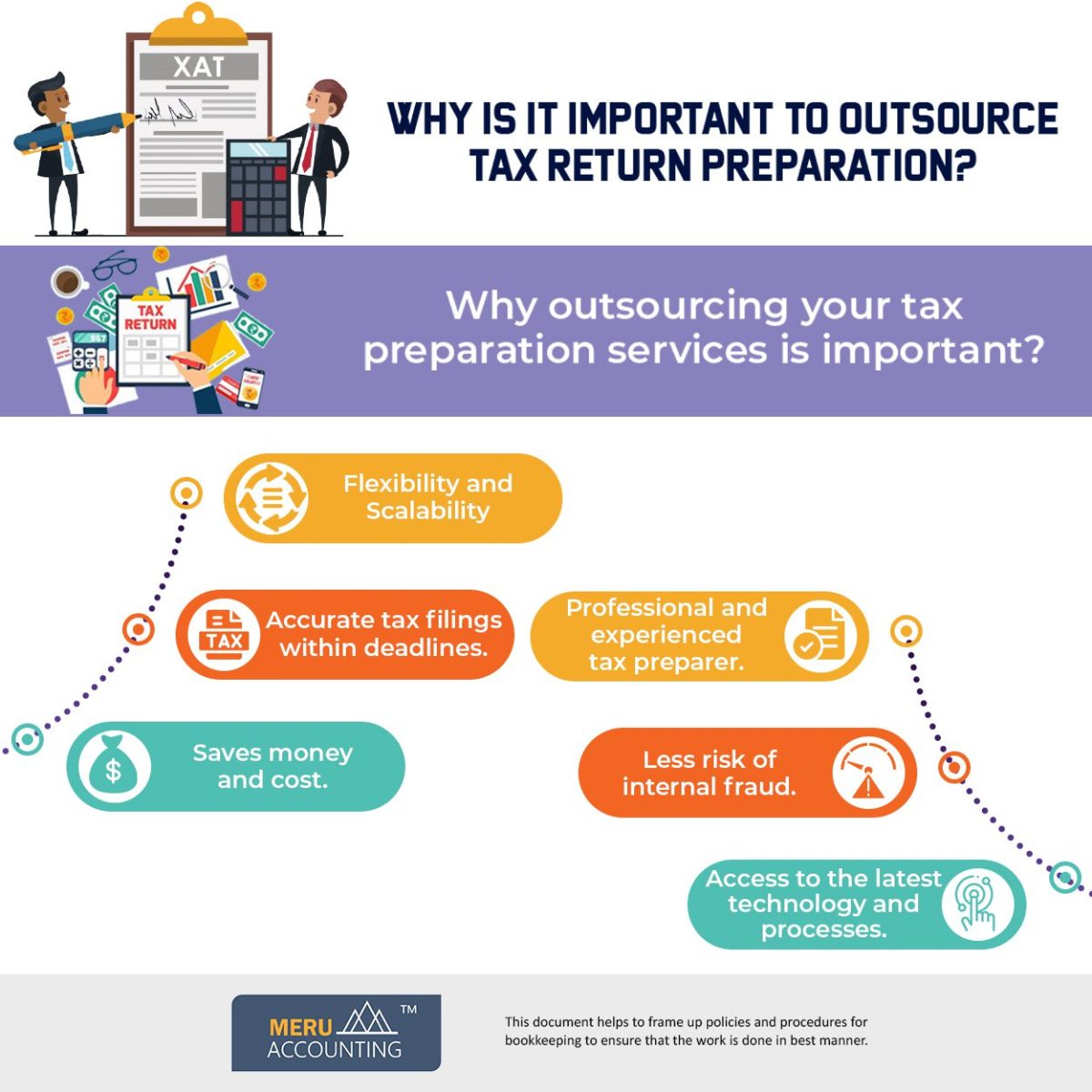

Numerous entities in established nations have actually now started outsourcing their job of tax prep work to countries like India. The reason for the very same is that India has an abundance of certified tax experts that hold knowledge in tax obligation preparation for foreign nations. The services can be availed at somewhat reduced prices in contrast to the home nation.

Some Known Factual Statements About Tax Preparation Near Me

On the various other hand, in India, the same work, without making any kind of compromise on the high quality, can be done at almost half the cost. India additionally has actually the required framework and also technology to be able to supply the tax obligation preparation services successfully to the foreign clientele. At Enterslice, we embark on the adhering to step-by-step procedure for tax prep work for our customers: The procedure begins with the client sending out checked documents, which are relevant to tax prep work.Report this wiki page